How to Use a Credit Card Imprinter: A Step-by-Step Guide for Retailers

Why Use a Credit Card Imprinter?

In an era of digital payments, the manual credit card imprinter—also known as the knuckle buster credit card machine—still holds relevance. Whether as a backup for power outages or a necessity in remote areas, a credit card maker machine ensures seamless transactions when electronic systems fail.

Retailers who understand how to properly use an imprint credit card system can provide uninterrupted service, secure transactions, and maintain records efficiently. Here’s a step-by-step guide to using a manual credit card machine effectively.

1. Gather the Necessary Materials

Before using a credit card imprint machine, ensure you have the following items:

A credit card imprinter (manual device) The device is used to imprint carbon-copy sales slips or charge slips. A merchant identification plate is used The customer’s credit card A secure location to store completed transactions.

Retailers can purchase high-quality imprinters and supplies from POS Paper.

2. Set Up the Manual Credit Card Imprinter

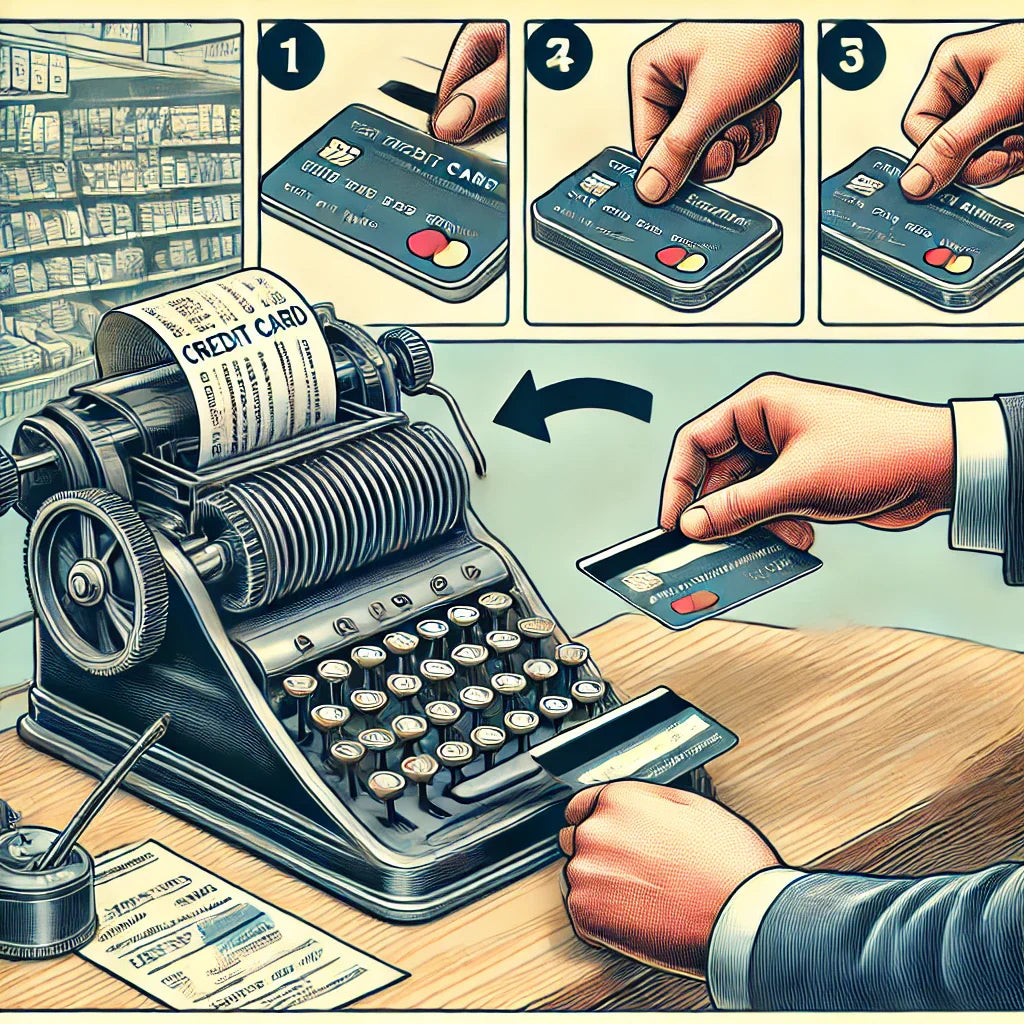

To begin using a manual credit card imprinter, follow these steps:

-

Insert the charge slip into the imprinter, ensuring it is correctly aligned.

-

Place the credit card face-up in the designated slot.

-

Position the merchant identification plate on the slip (if required).

This setup ensures a smooth transaction process and a clear imprint of the customer’s card details.

3. Create a Credit Card Imprint

Once everything is set up:

-

Hold the knuckle buster firmly and slide it across the charge slip.

-

Apply steady pressure to ensure a complete impression of the card’s details.

-

Slide the imprinter back to its original position.

-

Remove the slip and check that the imprint is legible, with all necessary information clearly visible.

4. Have the Customer Sign the Receipt

Give the customer a copy of the credit card imprint machine receipt. Retain a copy for your records. Ensure the customer signs the sales slip to authorize the transaction.

For added security, store completed slips in a locked, secure location.

5. Submit the Transaction for Processing

Once the transaction is complete:

-

Retain the imprinted slips for later batch processing.

-

If required, enter the transaction details manually into your digital system.

-

Store the paper receipts securely for record-keeping and chargeback protection.

Benefits of Using a Credit Card Imprinter

Backup Solution – Works without power or internet. Prevents Downtime – Ensures smooth transactions during system failures. Secure Transactions – Leaves a physical record for verification. Ideal for Remote Locations – Useful for businesses without electronic access.

Retailers looking to invest in high-quality credit card imprinters can browse the selection at POS Paper.

Final Thoughts: Keep Your Business Running with a Credit Card Imprinter

Even in today’s digital world, a manual credit card machine is a crucial tool for retailers. By following this guide, you can ensure that your business stays prepared for any situation. Whether as a backup or a primary solution, a credit card imprinter remains a reliable way to accept payments securely.

Looking for the best knuckle buster credit card machine? Visit POS Paper for premium-quality credit card imprint machines and supplies today!